Take Control of Your Finances With a Nashville Small Business Accountant

As a small business owner, managing your finances effectively is crucial to your success. Our Nashville-based financial management services, staffed with accountants and CPAs, are designed to empower you with the expertise and guidance needed to take control of your finances and maximize your business potential.

A Nashville small business accountant is someone who provides valuable advice and handles the intricate financial details for you, giving you the confidence and knowledge to focus on your core business functions and activities.

Partnering with our firm ensures you’ll have the financial support and insight you need to make informed decisions and propel your business forward.

Financial Guidance From Small Business CPAs to Help Your Business Thrive

We understand that each small business has unique financial complexities, which is why we offer tailored solutions and business advisory services to meet your specific needs.

We Help You Understand the Financial Structure of your Business

Our team of accountants, many of whom have their Certified Public Accountant (CPA) license, works with you to assess your current position, listen to your needs, ask about your challenges, identify areas for improvement, and help you to develop a plan for future growth. Sometimes you don’t know what your accounting needs are, and we can help with that.

We offer tailored advice and guidance, helping you, as a business owner, to make the most of your finances and achieve your business goals.

Streamlined Bookkeeping and Accounting Processes

Our team of small business CPAs helps you establish efficient bookkeeping and accounting processes that save you time and effort.

By utilizing the latest accounting software and technology solutions, we automate routine tasks and ensure accurate financial records and other important financial documents are maintained.

This streamlined approach allows you to focus on running your business while having a clear understanding of your financial position at all times.

Improved cash flow management and forecasting

Our expert accountants assist you in managing your cash flow effectively by monitoring income, expenses, and working capital.

We provide accurate forecasting and help you identify potential cash flow issues before they become critical.

With our guidance, you’ll gain the ability to make informed decisions that optimize your cash flow and strengthen your business’s financial health.

Comprehensive Financial Management Solutions From Small Business CPAs

We provide comprehensive financial management solutions designed to suit the specific needs of your business.

Establish a Budget and Monitor Spending Habits

At the core of any financial planning is setting up a budget and monitoring spending habits. We can help you understand where your money goes and how to develop strategies to manage it more efficiently. We can also provide advice on how to reduce costs, increase revenue, or capitalize on new opportunities.

Our team helps you establish a realistic budget that aligns with your business goals and objectives.

Our accounting services also include the option to monitor your spending habits, identifying areas where you can cut costs, increase efficiency, and optimize your financial resources for maximum growth.

Set Up a System to Track Finances

For any business to succeed, it is vital to have a system in place for tracking finances.

Our team can help you set up and maintain an effective recordkeeping system that tracks all your financial activities. This will allow you to make informed decisions about how to manage your resources and ensure that every dollar counts.

Use Accounting Software to Automate Accounting Tasks

It can be time-consuming and difficult to manage complex accounting tasks manually.

By automating routine tasks such as invoicing, payroll, and expense tracking, you’ll save time and minimize the risk of errors.

With our expertise, you can confidently harness the power of accounting technology to streamline processes, maintain precise financial records, and make data-driven decisions that contribute to your business’s success.

Analyze Cash Flows on a Regular Basis

Regular cash flow analysis is crucial for maintaining the financial health of your small business.

Our team of experienced accountants helps you track and analyze your income, expenses, and cash flow, allowing you to identify trends, potential issues, and areas for improvement.

With our guidance, you can develop effective strategies for managing cash flow and making informed decisions that promote stability and growth.

By understanding your cash flow patterns, you can plan for future investments, reduce financial risks, and ensure your business has the necessary resources to seize new opportunities.

Evaluate Your Banking Services and Insurance Coverage

Choosing the right banking partner is essential for your small business’s financial success.

Our team can help you evaluate and select the best banking options tailored to your specific needs.

We also assist you in understanding and acquiring the appropriate insurance coverage to protect your business from unforeseen events and potential liabilities. We act in your best interest.

Tax Planning and Tax Prep

Efficient tax planning is crucial for maximizing your business’s financial resources. Our small business accountants provide expert advice on tax planning strategies that help you minimize your tax obligations and stay compliant with relevant regulations.

By staying proactive and informed about current tax laws, we ensure that your business takes advantage of every available tax-saving opportunity. We also offer tax preparation services.

Establish Effective Internal Controls

Effective internal controls are vital for safeguarding your business’s assets and ensuring the accuracy of financial reporting.

Our team can help you implement strong internal controls by designing and implementing policies and procedures that minimize the risk of fraud, errors, and waste.

We’ll work with you to create a robust financial control environment that promotes accountability and transparency in your business operations.

Utilize Technology Solutions

Modern technology solutions can provide valuable insights and efficiency improvements for small businesses.

Our team can help you identify and implement the right technology solutions for your specific needs, including accounting software, financial analysis tools, and automated processes.

By leveraging technology, you can streamline your financial operations, gain better insights into your business’s financial health, and make data-driven decisions that support your growth objectives.

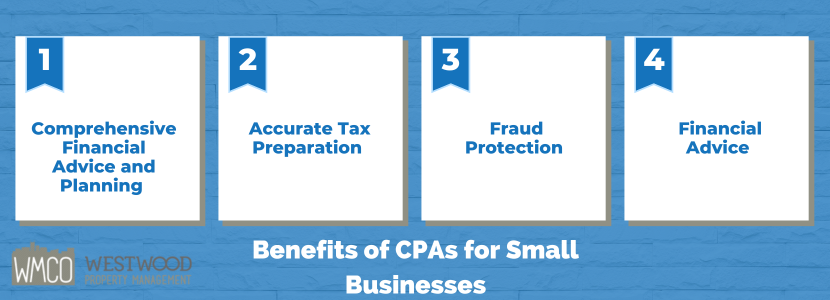

Benefits of CPAs for Small Businesses

The ability to leverage the expertise of a CPA is essential for any small business looking to take its financial operations to the next level. Here are some of the key benefits a CPA can offer:

Comprehensive Financial Advice and Planning

CPAs provide experienced guidance and assistance to small business owners on all aspects of their finances, including budgeting, cash flow management, financial statements, investments, taxes, and more.

CPAs have extensive knowledge of accounting, tax laws, and financial regulations, ensuring that your small business stays compliant and avoids costly mistakes.

Accurate Tax Preparation

A CPA can help you accurately prepare your individual and business tax returns, including payroll taxes. A CPA can also provide advice on the best strategies to take advantage of available deductions and credits, so you pay only what you owe.

By outsourcing tax services to CPAs, small business owners minimize tax liabilities and maximize tax-saving opportunities, resulting in improved financial performance.

Fraud Protection

CPAs have specialized knowledge of financial processes and regulations that help them identify potential fraud or mismanagement. They can review your accounts with a critical eye and alert you to any irregularities.

They can also provide guidance on how to strengthen your internal controls and reduce the risk of fraud or waste.

Financial Advice

CPAs are trained to interpret financial statements, perform financial analysis, and make informed recommendations for boosting profitability or controlling expenses.

In addition, they can assist with strategic planning and forecasting, helping you better manage your resources and plan for the future.

Challenges of Financial Management for Small Businesses

Entrepreneurs and small business owners often have limited resources, including budget constraints, time constraints, and limited access to financial expertise.

This can make it difficult for a small business owner to effectively manage their finances and make informed decisions.

Lack of financial expertise

Many small business owners lack formal training in financial management and may not have a background in accounting or finance. This can lead to challenges in understanding complex financial concepts and making strategic financial decisions.

It’s often difficult to know what your accounting needs are. We work closely with you to explain what is standard in the industry and what options are available to you.

Time-consuming Tasks

Managing finances can be time-consuming, especially when dealing with manual processes and complex financial regulations. Small business owners often struggle to balance their financial responsibilities with the day-to-day demands of running their businesses.

Cash Flow Management

Small businesses frequently face cash flow challenges, such as late payments from customers, seasonal fluctuations in revenue, and unexpected expenses.

These challenges can make it difficult for small businesses to maintain a healthy cash flow and meet their financial obligations.

Keeping Current with Regulations and Tax Laws

Small business owners need to stay up-to-date on financial regulations and tax laws, which can be time-consuming and complex. Failure to comply with these regulations can result in fines, penalties, and legal issues.

Limited Access to Financing

Small businesses often have limited access to financing options, making it difficult to secure funds for growth, investments, or to cover unexpected expenses. This can hinder the business’s ability to expand and take advantage of new opportunities.

Partnering with a Nashville small business accountant can help overcome these challenges by providing expert advice, tailored solutions, and comprehensive financial services.

This support can help small businesses navigate complex financial landscapes, make informed decisions, and ultimately achieve their business goals.

When to Hire a Small Business Accountant Nashville TN?

You should consider hiring a Nashville small business accountant if you:

- Need help understanding or managing business finances.

- Want to gain insight into financial processes, systems, and best practices.

- Require assistance with budgeting and forecasting.

- Are looking to improve profitability through cost-effective initiatives.

- Need access to expert tax planning and preparation services.

- Seek guidance on navigating financial regulations and staying compliant.

- Want assistance in setting up and maintaining accurate bookkeeping and accounting systems.

- Need relief from payroll processing.

- Require help with cash flow management and monitoring.

- Are considering expanding your business or making significant investments.

Ultimately, the right time to hire a small business accountant in Nashville, TN depends on your unique business needs and circumstances.

If you find yourself facing any of the above-mentioned situations or feel overwhelmed by your financial responsibilities, it may be time to seek the support and guidance of a professional accountant.

By partnering with an experienced Nashville small business accountant, you can gain valuable insights, make informed financial decisions, and set your business on a path to success.

FAQs About Financial Management

Is it worth it to hire an accountant for a small business?

Yes, hiring an accountant for a small business can be worth it, as they provide valuable financial expertise, guidance, and support. Accountants can help with tax planning and preparation, cash flow management, budgeting, and financial analysis, which can contribute to your business’s overall success.

What should an Accountant do for a Small Business?

An accountant should help with financial management, including bookkeeping, tax planning and preparation, cash flow analysis, budgeting, financial reporting, and forecasting. They should also provide guidance on financial regulations, help establish effective internal controls, and advise on leveraging technology solutions for improved efficiency.

How Many Small Businesses Use Accountants?

It’s difficult to provide an exact number, as this varies depending on factors such as location, industry, and business size. However, many small businesses recognize the value of working with an accountant to manage their finances and make informed decisions.

What Should I Ask My CPA About Owning a Small Business?

You can ask your CPA about:

- Tax planning and preparation strategies.

- Bookkeeping and accounting best practices.

- Cash flow management and forecasting.

- Budgeting and expense tracking.

- Financial regulations and compliance.

- Internal controls and fraud prevention.

- Evaluating and securing financing options.

- Business growth strategies and investment opportunities.

How do I choose the Right CPA?

To choose the right CPA, consider factors such as:

- Experience in your industry.

- Qualifications and certifications.

- Reputation and references from other clients.

- Availability and communication style.

- Range of services offered.

- Technology solutions utilized.

- Pricing structure and fees.

How Much Does a CPA For Small Business Cost?

The cost of hiring a CPA for a small business can vary widely based on factors such as the services provided, the complexity of your financial situation, and the accountant’s experience and location. Fees may be charged hourly, as a flat rate, or on a retainer basis. It’s essential to discuss pricing upfront and obtain a clear understanding of the fee structure.

How Much Does it Cost to Use a Wealth Manager?

Wealth managers typically charge a percentage of assets under management (AUM), which can range from 0.25% to 1.5% or more, depending on the amount of assets and the complexity of the services provided.

Some wealth managers may also charge hourly fees, flat rates, or retainer fees, so it’s essential to understand the fee structure before engaging their services.

What is the Minimum Income to Hire Someone for Wealth Management for Small Business?

There is no set minimum income for wealth management for small business, as different wealth managers have different minimum asset requirements.

Some may work with clients with as little as $100,000 in investable assets, while others may require $1 million or more. It’s important to research potential wealth managers and inquire about their minimum asset requirements.

Is it Worth it to Hire a CPA for Wealth Management?

Hiring a CPA for wealth management can be worth it if you have significant assets, a complex financial situation, or need expert guidance on tax strategies, investments, and financial planning.

A CPA can provide valuable insights and advice to help you manage your wealth, minimize taxes, and achieve your financial goals. However, if your financial situation is relatively simple, you may not require the specialized services of a CPA for wealth management.

Is Hiring a Nashville Small Business Accountant Right for Me?

Small business owners in need of accounting services should consider hiring a Nashville small business accountant.

A qualified CPA for small business can provide personalized service and expert advice to help you better manage your finances, save money on taxes, and make informed financial decisions.

Find out how our tailored financial management solutions can help you grow and succeed. Contact us today for a consultation!